What is the IRS 1095-C form?

By Becky Stephenson, human resources

In January 2016, full-time employees will receive a new tax form, Form 1095-C, that will contain detailed information about their health care coverage. It is important to keep the form for your records, because you will need it to file your tax returns for 2015.

In January 2016, full-time employees will receive a new tax form, Form 1095-C, that will contain detailed information about their health care coverage. It is important to keep the form for your records, because you will need it to file your tax returns for 2015.

Q: What is Form 1095-C?

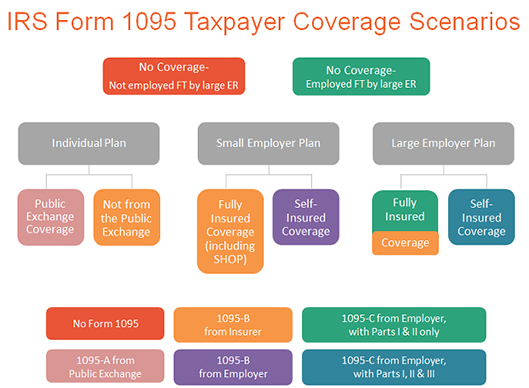

A: Beginning in 2016, Miami University must file Form 1095-C with the IRS to report information about the offers of health coverage made to our full-time employees during the previous calendar year. The form is required under the Affordable Care Act (ACA). It contains detailed information about the medical coverage offered to you and your dependents by Miami. You will need the information as part of your federal tax return for 2015. The IRS will use this information, in part, to validate your compliance with the ACA’s individual shared responsibility requirements. Think of the form as your “proof of insurance” for the IRS.

If you were considered a full-time employee at any point in 2015 you will receive Form 1095-C, even if you were not enrolled in a Miami University health plan.

A sample form can be found at https://www.irs.gov/pub/irs-pdf/f1095c.pdf.

Q: Isn’t my health coverage information already included on my Form W-2 using Box 12, code DD?

A: The information included on your Form W-2, Box 12, code DD only states the total cost of employer- sponsored health insurance you actually enrolled in during a single calendar year. It does not show the months in which you enrolled in coverage or the lowest cost employee-only coverage offered to you. Form 1095-C shows that information.

Q: When should I receive a copy of my form?

A: The IRS has set the deadline of March 31, 2016, however, Miami plans to distribute the forms earlier. It has not been determined at this time if forms will be mailed to homes or available electronically.

Q: Should my spouse/partner or dependents receive their own copies?

A: Generally, no. Form 1095-Cs are only required to be provided to full-time employees. However, a spouse/partner and/or dependent may receive his/her own copy if he/she independently enrolls in COBRA coverage and you do not enroll in COBRA coverage (e.g., in the event of a divorce).

If you are a Miami employee but covered under a Miami employee spouse/partner, you will not receive a form. Your coverage information will be provided on the form of the person who carries the coverage.

If you are a Miami employee but covered under a Miami employee spouse/partner, you will not receive a form. Your coverage information will be provided on the form of the person who carries the coverage.

Q: What information is on Form 1095-C?

A: There are three parts to the form:

Part I (Lines 1 - 13) includes information about you and your employer.

Part II (Lines 14-16) reports information about the coverage offered to you by Miami University, the affordability of the coverage offered, and the reason why you were or were not offered coverage.

Part III (Lines 17-22) reports information about the individuals covered under your plan. Please note:

- A date of birth will be entered in column (c) only if the dependent’s social security number is not on file with Benefits & Wellness.

- Column (d) will be checked if the individual was covered in all 12 months of 2015.

- For individuals who were covered for some but not all months, information will be entered in column (e) indicating the months for which these individuals were covered.

- If there are more than six covered individuals, see the additional covered individuals on Part III, Continuation Sheet(s).

Q: Who can I contact for more information or if information on the forms is incorrect?

A: Contact Benefits & Wellness at 513-529-3926 or benefits@miamioh.edu.

Q: If information is incorrectly entered on the Forms, will I receive corrected copies?

A: Yes, you will receive a corrected copy if any of the information is incorrect.