FSB real estate program grows inside, outside the classroom

Only a few years into offering a degree, the Farmer School of Business real estate program is looking to the future

FSB real estate program grows inside, outside the classroom

In a Farmer School of Business classroom on a Sunday afternoon, a student organization focused on commercial real estate holds a meeting to go over the club’s homework from the previous Sunday and announce a new assignment.

In Shiedler Hall’s largest classroom, three teams of students present their ideas for financing a multi-family apartment complex in Cleveland to a group of executives.

In FSB’s Taylor Auditorium, real estate executives hold a pair of panels to discuss how to raise equity in commercial real estate and what it’s like working as someone raising that equity.

The Real Estate program in the Farmer School of Business Department of Finance might be one of the busiest programs that many people might not know even exists.

Real estate classes have been offered at the Farmer School of Business for quite some time, but only in the last few years did it become an option in which students could major. A combination of student requests and an alumni gift helped make the degree program possible. In 2022, the Center for Real Estate Finance and Investment (REFI) was created to be a focal point for the growing real estate program.

Real estate classes have been offered at the Farmer School of Business for quite some time, but only in the last few years did it become an option in which students could major. A combination of student requests and an alumni gift helped make the degree program possible. In 2022, the Center for Real Estate Finance and Investment (REFI) was created to be a focal point for the growing real estate program.

“Our goal is to ensure that our students graduate beyond ready to launch their careers. The combined interest from students and the opportunities in this fast-growing field provided the “why” for this initiative and we are fortunate to have the support of our alumni,” stated Jenny Darroch, Dean and Mitchell P. Rales Chair in Business Leadership in 2022. “Our real estate major and minor not only require course work in the breadth of our business disciplines, but they also incorporate coursework in the Geography/Urban Planning Department as well as some opportunities to work with the Architecture Department.”

“Real estate is a broad industry, so there's a lot of roles you can have, and in a lot of those areas, the pay is fairly lucrative,” Tyler Wiggers, assistant lecturer of Finance & director of Industry Partners and Engagement for the Center for REFI, said. “What also makes real estate unique is that you can invest in very large or small ways, you don't have to have a lot of resources, and it’s very entrepreneurial.”

“Real estate is a broad industry, so there's a lot of roles you can have, and in a lot of those areas, the pay is fairly lucrative,” Tyler Wiggers, assistant lecturer of Finance & director of Industry Partners and Engagement for the Center for REFI, said. “What also makes real estate unique is that you can invest in very large or small ways, you don't have to have a lot of resources, and it’s very entrepreneurial.”

He noted that unlike some careers, someone getting into real estate doesn’t have to know everything about real estate – there are related businesses that they can outsource as many aspects as needed.

“Commercial real estate is the world's greatest side hustle. You could work at Proctor & Gamble or Fifth Third Bank and still own commercial real estate,” Wiggers said.

The Farmer School of Business has had a student-run real estate club for several years, but last year some members decided to create another opportunity within it – Redhawk Real Estate Investments.

“My friends and I wanted to create a commercial real estate workshop, essentially. We wanted to create a club where the students can come in and learn how to underwrite properties and value them, and then potentially pitch it to an investment committee,” Michael Leccese said. “It’s a way for us to get real-world, hands-on investment experience in real estate.”

“My friends and I wanted to create a commercial real estate workshop, essentially. We wanted to create a club where the students can come in and learn how to underwrite properties and value them, and then potentially pitch it to an investment committee,” Michael Leccese said. “It’s a way for us to get real-world, hands-on investment experience in real estate.”

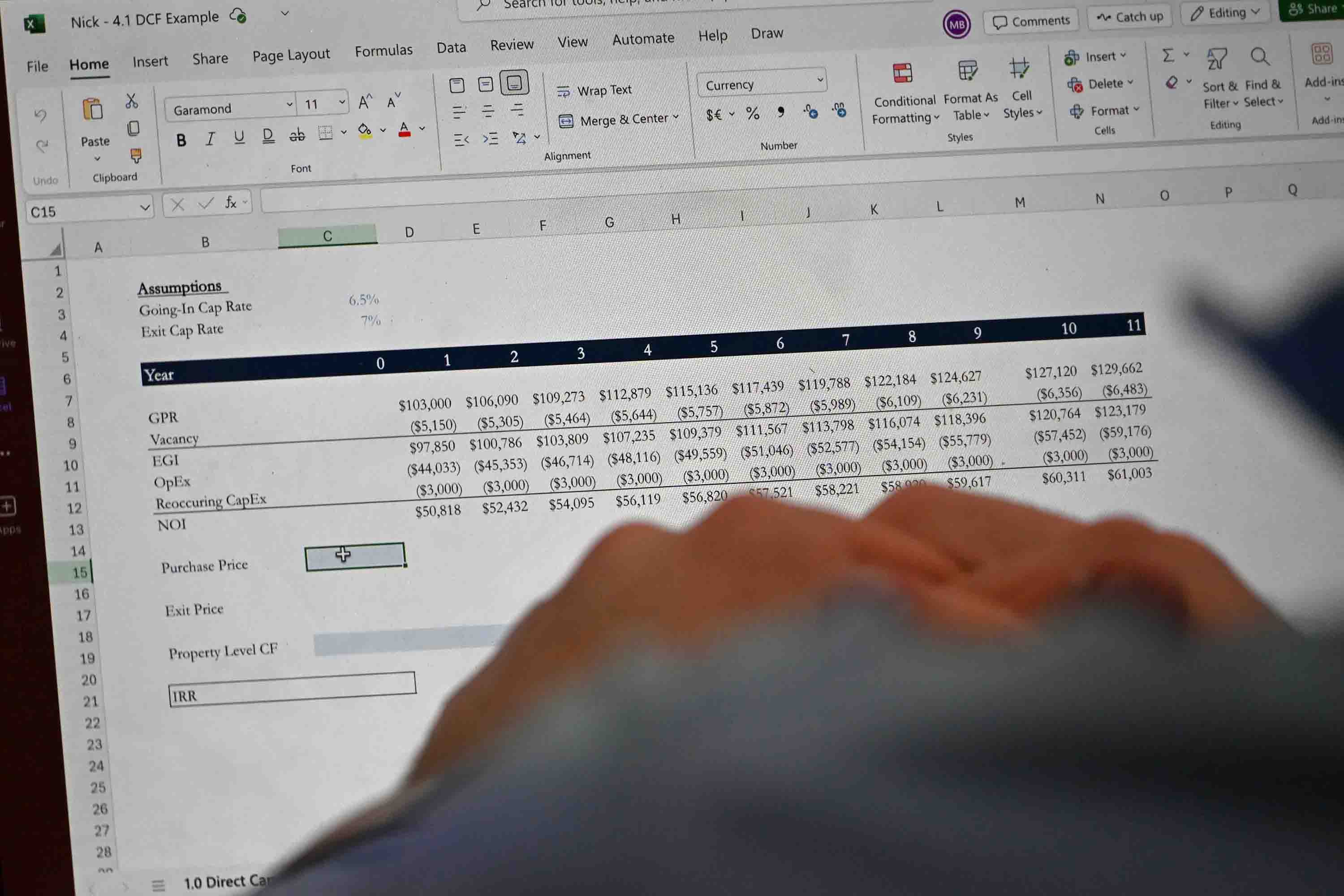

“We have a new member education program where we train our new analysts in underwriting skills, like discount cash flows and equity waterfalls, so that they can have a comprehensive understanding of how to underwrite a real estate deal,” Victor Berger said. “And those skills are directly transferable to their internships or the prospective jobs.”

Abby Renners is one of those new members. “I'm trying to be a sponge and soak up as much information as I possibly can, because real world experiences and working on actual cases is honestly the best education you can get in school,” she said. “Until you actually put it into motion and do the actual modeling in the work, you're not going to know if you can actually do it or not.”

“The real estate club is great because it gets people involved early and they can understand and learn what commercial real estate is at a very high level. And then this is more in depth, learning ‘How do you actually do commercial real estate? What are the jobs in real estate? How do you analyze a property?’” Griffin Boothby said.

“The real estate club is great because it gets people involved early and they can understand and learn what commercial real estate is at a very high level. And then this is more in depth, learning ‘How do you actually do commercial real estate? What are the jobs in real estate? How do you analyze a property?’” Griffin Boothby said.

Boothby, Renners, and Leccese, along with Christopher Fry and Tiegan Witte, won the “Best Pitch” award at the Harold E. Eisenberg Foundation Real Estate Challenge earlier this month, one of more than 20 schools taking part.

“A lot of alumni also don't understand the magnitude of the real estate program at Miami in general. A lot of them barely know we have a real estate program. So this is putting the word out there and it's showcasing students’ abilities to them, which in turn will help place us into jobs,” Boothby said.

Michael Lonsway is not one of those unaware alumni. “I've been involved with the real estate program here at Miami since before it was a real estate program, and to see the evolution of it from year to year has been really amazing,” the chief financial officer at BWE and 1990 Accounting alum said. “It's really making leaps and bounds.”

Michael Lonsway is not one of those unaware alumni. “I've been involved with the real estate program here at Miami since before it was a real estate program, and to see the evolution of it from year to year has been really amazing,” the chief financial officer at BWE and 1990 Accounting alum said. “It's really making leaps and bounds.”

Lonsway brought several of his executives to Miami to judge the finals of the BWE case competition last month. “I thought the presentations were fantastic. I thought the teams did a very good job of understanding the materials and presenting it really well, the best work we've seen since the case competition’s conception,” he said.

Days later, Mark Allen, president & chief development officer at Royal Oak Realty Trust, was one of nine commercial real estate executives to speak with students during the spring Real Estate Conference. “It’s awesome to see what the school's done with the real estate program,” the 2000 Finance graduate said. “You guys are in a great spot, so keep hustling. I was never at a Monday night panel like you are when I was here at Miami, so you guys are all hustling already.”

Days later, Mark Allen, president & chief development officer at Royal Oak Realty Trust, was one of nine commercial real estate executives to speak with students during the spring Real Estate Conference. “It’s awesome to see what the school's done with the real estate program,” the 2000 Finance graduate said. “You guys are in a great spot, so keep hustling. I was never at a Monday night panel like you are when I was here at Miami, so you guys are all hustling already.”

“We are working on about six different items to grow Miami's real estate presence. One of those items is support of our alumni, and this event was structured so we can create engagement between our alumni and students,” Wiggers told students and participants.

Another panelist in the event, 2008 Finance alum Chris Saltis, Principal at True North Management Group real estate private equity firm, said “I’m impressed by Miami students’ general interest and knowledge in the space. Though the official real estate program is in its early days, it is already quickly establishing itself, unsurprisingly. Tyler Wiggers and others have created a clear plan to elevate awareness of it and provide practical exposure to students in part through encouraging active dialogue with alumni in real estate, like myself.”

Another panelist in the event, 2008 Finance alum Chris Saltis, Principal at True North Management Group real estate private equity firm, said “I’m impressed by Miami students’ general interest and knowledge in the space. Though the official real estate program is in its early days, it is already quickly establishing itself, unsurprisingly. Tyler Wiggers and others have created a clear plan to elevate awareness of it and provide practical exposure to students in part through encouraging active dialogue with alumni in real estate, like myself.”

“Miami's real estate program is one of the fastest growing real estate programs in the Midwest, and it benefits from having a very deep alumni group that are involved in the real estate business scattered across the country,” Michael Moses, 1989 Accountancy alum and Executive Managing Director-Business Development at GBX Group, said. “It also benefits from being in close proximity to major markets such as Chicago, Cleveland, Pittsburgh, Indianapolis, Cleveland, Columbus, Cincinnati, Louisville, each of which offers a wide array of real estate opportunities.”

“More of these young adults reach out to me for separate meetings, reach out to me before, during, and after events and lectures,” Moses said. “Compared to students from six, seven years ago, they are more engaged, asking more questions, understanding more about the dynamics of real estate, and I think that'll just continue as the program continues to flourish.”

“More of these young adults reach out to me for separate meetings, reach out to me before, during, and after events and lectures,” Moses said. “Compared to students from six, seven years ago, they are more engaged, asking more questions, understanding more about the dynamics of real estate, and I think that'll just continue as the program continues to flourish.”